Are you tired of living paycheck to paycheck? Constantly worried about unexpected expenses or emergencies? Explore Dave – the financial wellness app that has revolutionized the way we handle our finances. With its convenient cash advance feExature, Dave provides its users with quick access to their earned wages before payday, saving them from costly overdraft fees or high-interest payday loans. But what if you could bring this financial freedom to even more people through your own app? Imagine helping countless individuals take control of their finances and live stress-free, with just a few taps on their phones. That’s where we come in – to guide you through the process of developing a cash advance app like Dave.

From understanding the business model to determining the features to include, in the actual development process – this comprehensive guide will cover it all.

Dave App: Overview

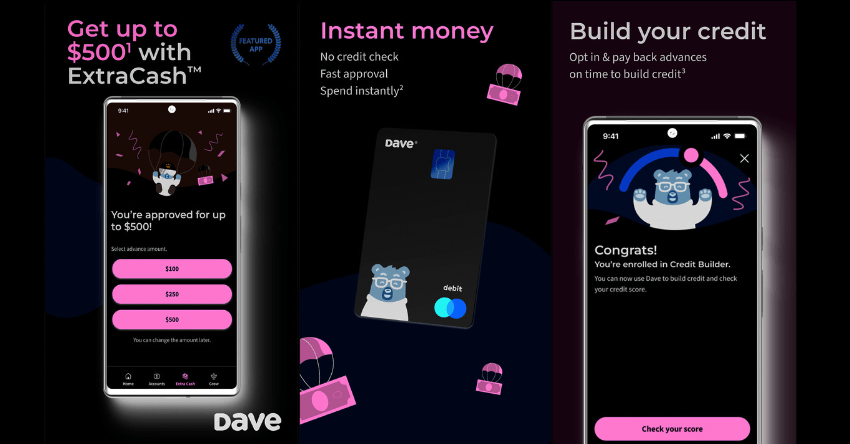

Dave app can be thought of as a personal financial concierge, providing users with a comprehensive solution for managing their finances and avoiding overdraft fees. By combining short-term loans, real-time bank account monitoring, and budgeting tools, Dave gives users the tools they need to take control of their finances and avoid unexpected financial hardships.

With Dave, users can easily request small loans to cover unexpected expenses, get real-time notifications to avoid overdraft fees, and easily track their spending and budget. The app also provides users with the ability to repay loans on their own terms, offering flexibility and peace of mind.

So, in a nutshell, Dave like cash advance app serves as a one-stop-shop for all your financial needs, helping you manage your finances, avoid financial pitfalls, and achieve your financial goals with ease.

The Difference Between Creating a Cash Advance App and a Money Lending App

Purpose

The primary difference between a cash advance app and a money lending app is its purpose. A cash advance app is designed to provide users with a small, short-term loan to help cover unexpected expenses, such as a broken car or medical bill. A money lending app, on the other hand, is intended to provide larger, longer-term loans to assist users in achieving certain financial goals, such as purchasing a home or starting a business.

Credit Amounts

Typically, cash advance app provide lesser loan amounts, ranging from $50 to $500. Depending on the user’s credit score and financial circumstances, money lending applications can offer loans ranging from few thousand to several hundred thousand dollars.

Loan Terms

The repayment terms for cash advance loans range from a few weeks to a few months. Money lending loans, on the other hand, can have repayment terms ranging from a few years to several decades.

Interest Rates

Cash advance loans have higher interest rates than money lending loans. This is due to the fact that cash advance loans are intended to provide quick access to funds and are often regarded as high-risk loans. Money lending loans, on the other hand, typically have lower interest rates, as they are designed to provide longer-term financing for specific financial goals.

Application Process

In general, the application process for a cash advance app is more streamlined and takes less time than that of a money lending app. This is due to the fact that cash advance loans are smaller and have shorter repayment terms, requiring less documentation for approval. Money lending loans, on the other hand, often demand additional information, such as a credit check and income verification, to evaluate the user’s creditworthiness and ability to repay the loan.

User Profile

The user profiles for cash advance apps and money lending apps are also different. Users of cash advance apps seek immediate access to funds to pay unexpected bills, but users of money lending apps seek long-term financing to fulfill specified financial goals.

Dave App: How Does It Work?

Sign up and bank account connection:

To start using Dave, a user must download the app and create an account. During the sign-up process, the user will be prompted to connect their bank account to the app. This allows Dave to monitor the user’s financial activity in real-time and provide real-time notifications if there is a risk of an overdraft.

Loan eligibility and loan request:

Once a user’s bank account is connected, Dave uses the information along with other data sources to create a personalized financial profile for the user. This profile is used to determine the user’s loan eligibility and the amount of money they can borrow. If a user is eligible for a loan, they can request it directly through the app. Dave offers short-term loans of small amounts, typically ranging from $25 to $75, to cover unexpected expenses until the user’s next paycheck arrives.

Approval and funding:

If a loan request is approved, the funds will be transferred to the user’s bank account within one business day. The user can then use the funds to cover unexpected expenses or pay bills.

Repaying the loan:

When the loan is due, the user can pay it back in full or set up an automatic payment from their bank accounts. Dave provides flexible repayment options, so users can choose the one that works best for them. The app also provides reminders and notifications to help users stay on top of their loan repayment.

Real-time monitoring:

Dave helps users avoid overdraft fees by monitoring their bank account in real time. The app sends notifications if there is a risk of an overdraft, allowing users to take action and avoid costly fees. This feature provides peace of mind and helps users stay on top of their finances.

Budgeting tools:

Dave also includes budgeting and spending tracking tools to help users better manage their money. The app provides insights into spending patterns and helps users create a budget that works for their financial situation. This feature helps users stay on track with their finances and reach their financial goals.

Business Model of Dave App: How It Generates Revenue?

Dave generates revenue through several different channels:

Loan interest:

Dave’s primary source of revenue is the interest charged on loans. When a user takes out a loan through the app, they are charged a fixed fee, which includes the interest and any other fees associated with the loan. This interest provides a steady stream of revenue for Dave, as users take out loans to cover unexpected expenses until their next paycheck arrives.

Overdraft protection fee:

Dave offers overdraft protection services to its users, and charges a fee for this service. When a user’s bank account is in danger of going into overdraft, Dave transfers funds from the user’s overdraft line of credit to cover the overdraft, avoiding any additional overdraft fees from the bank. This service provides a convenient solution for users who frequently experience overdrafts, and generates additional revenue for Dave.

Premium membership:

Dave offers a premium membership program for a monthly fee, which includes additional features and services not available to non-paying users. These additional services may include higher loan limits, additional overdraft protection, and access to additional budgeting and financial wellness tools. Dave is able to bring in more cash from customers who wish to use more of the financial services by enrolling them in the premium membership program.

Affiliate marketing:

Dave may also generate revenue through affiliate marketing, where they receive a commission for promoting other financial products and services to their users. By partnering with other financial companies, Dave is able to offer its users a wide range of financial products and services, and generate additional revenue in the process.

Advertising:

By using data collected from its users, Dave can target advertisements to users based on their interests, financial situation, and spending habits. This targeted advertising provides a more relevant and engaging experience for users, while also generating additional revenue for Dave.

Expansion into other financial products:

As Dave continues to grow, it may expand into other financial products, such as savings accounts, credit cards, and investment products. By offering a full range of financial products and services, Dave can increase its revenue and solidify its position as a comprehensive solution for managing finances. Dave has the potential to grow its revenue and customer retention by diversifying into additional financial services, thereby better meeting the needs of its users.

Unique Features To Be Included In A Cash Advance App Like Dave

Gamified savings:

Gamified savings is a fun and engaging way for users to save money. The cash advance app could include features like savings challenges, where users can compete with friends and family to see who can save the most, or a rewards system where users can earn points or rewards for meeting their savings goals. The purpose of this functionality is to improve the user experience of saving money and to facilitate the development of saving as a habit.

Investment advice:

Incorporating investment advice and resources into the cash advance app could help users grow their wealth in the long term. The app could provide educational content and investment recommendations based on the user’s financial goals and risk tolerance. Additionally, the app could potentially offer an investment platform where users can easily invest their savings in various financial instruments, such as stocks, bonds, or mutual funds.

AI-powered financial advisor:

An artificial intelligence-powered financial advisor is a feature that uses machine learning algorithms to provide personalized recommendations based on the user’s spending habits and financial goals. This feature can help users make informed decisions about their finances, from managing their budget to paying off debt and investing for the future.

Group loans:

A group loan is a feature that allows friends or family to pool their resources and support each other in times of financial need. This feature can be especially helpful for individuals who may not have a good credit score or are unable to access traditional forms of credit. Users can create a group and invite friends or family to join. When one member of the group applies for a loan, the entire group is responsible for paying it back.

Charitable giving:

Charitable giving is an option for users to donate a portion of their loan or savings to a charity or cause of their choice. This feature allows users to give back and make a positive impact, while also potentially receiving a tax benefit. The app could partner with various charities and causes to provide a range of giving options for users.

Virtual financial literacy classes:

Virtual financial literacy classes are online educational resources that teach users about various financial topics, such as budgeting, investing, and credit management. This cash advance app development feature could help users build their financial knowledge and become more confident in managing their money. The classes could be delivered through videos, webinars, or interactive modules.

Social impact loans:

Social impact loans are an option for users to invest in loans to small businesses in underserved communities, providing not only financial assistance but also a positive social impact. This feature allows users to make a difference in their communities and support the growth of small businesses. Users of the cash advance app may be able to take advantage of a variety of investment opportunities if developers strike up partnerships with lending organizations and community development finance institutions.

Integration with popular payment apps:

Integrating with well-known payment services like Venmo or PayPal streamlines the process of transferring money to and from the app. This capability could also facilitate more streamlined transactions and decrease the time required for consumers to access their funds. To further improve the app’s usability, developers can include integration with other popular payment applications that customers are likely already familiar with.

How to Develop an App Like Dave?

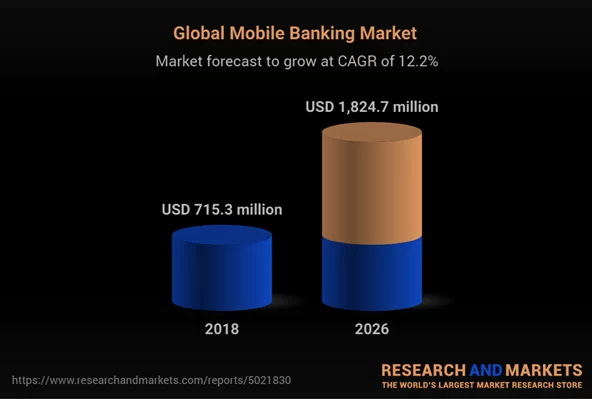

Conduct market research:

Market research is crucial for understanding the demand for cash advance apps, the competition, and the target audience. Research should include analyzing the features of similar apps and identifying what sets Dave apart from the competition. This will help you determine the unique value proposition of your app and what features and functionalities are important to include.

Define the scope of the project:

Defining the scope of the project involves setting clear goals and objectives for the app. This should include a list of key features and functionalities you want to include in the app and prioritize them based on their importance. This step will assist you to stay focused and avoid scope creep during the development process.

Choose the technology stack:

The technology stack you choose will have a significant impact on the performance, security, and scalability of your app. When deciding on a technology stack, it’s important to think about things like the target platform, the operating systems it needs to run on, and the necessary processing power. You may choose to develop the app using a cross-platform framework, such as React Native, or natively for iOS and Android.

Design the user interface:

The user interface is the face of the app and should be designed to be user-friendly and visually appealing. Keep the user experience in mind while you design the app’s UI, and make sure its most important features and functions are easily accessible. A well-designed interface can increase user engagement and reduce the likelihood of user churn.

Develop the backend:

The backend of the app includes the database and API, and is responsible for processing data and managing the app’s functionality. The backend should be scalable, secure, and able to handle large amounts of data. The backend should be hosted on a highly available and accessible cloud infrastructure like Amazon Web Services (AWS) or Google Cloud.

Integrate payment systems:

Integrating payment systems into the app is critical for allowing users to make transactions. If you want to make paying with your app more convenient for customers, you should think about integrating with services like PayPal and Venmo. You may also need to secure a payment gateway to process transactions and manage the flow of funds.

Implement security measures:

Security is a top priority for cash advance apps, and robust security measures should be implemented to protect sensitive user data and prevent unauthorized access. Consider using encryption, secure socket layer (SSL), and two-factor authentication (2FA) to enhance security. Regular security audits should also be conducted to identify and address potential security threats.

Test and debug the app:

Thorough testing and debugging is crucial for ensuring that the app is functioning correctly and free of bugs. Conduct user testing to get feedback on the app’s performance and make any necessary changes. There is potential for the development team to save time and effort by switching to automated testing technologies.

Launch the app:

Once the app has been tested and debugged, it is ready to be launched on the App Store or Google Play. Monitor the app’s performance and gather feedback from users to continuously improve its functionality and user experience.

Market and promote the app:

Marketing and promoting the app is essential for reaching a wider audience and driving downloads. To get your app noticed and get more people to download it, you should think about employing digital marketing tactics like social media, SEO, and influencer marketing. Partnering with other financial institutions or organizations can also help increase brand awareness and credibility. It may be helpful to offer referral bonuses or special promotions to users who spread the word about the app.

Top 5 Apps Like Dave

Earnin:

This app is designed to be a financial wellness solution for people who need access to their earned wages before payday. Unlike a traditional cash advance, Earnin doesn’t charge interest or fees, and users can withdraw as little or as much as they need from their available balance. To use the app, you simply connect your bank account and work schedule, and Earnin will calculate your available balance based on the hours you’ve worked. This makes it a great option for those who need a little extra financial help between paydays.

Chime:

Chime is a bank account on your phone that aims to help users take control of their finances. It offers a debit card, cash advances, overdraft protection, and fee-free spending. The app also helps users save money automatically with features like rounding up purchases to the nearest dollar and transferring the change to a savings account.

MoneyLion:

With MoneyLion, you can access up to $250 in cash advances with no interest or fees. The app also offers overdraft protection, which automatically transfers funds from your savings account to cover any overdrafts and help you avoid overdraft fees. MoneyLion is designed to help you achieve financial stability and independence, making it a great choice for those who want to improve their overall financial health.

Brigit:

Brigit is a cash advance app that provides users with up to $250 in cash advances. The app tracks your bank account and provides a cash advance if your balance dips below a certain amount, helping you avoid costly overdraft fees. Brigit also provides users with financial tools and insights to help them budget and manage their money better. The app operates on a monthly subscription model, and users can choose to pay more or less based on their financial situation.

Cash App:

Cash Advance App is a versatile app that combines the convenience of a payment app with the added benefits of cash advances. The app has a simple and user-friendly interface, making it easy for users to manage their finances on the go. Additionally, it offers a wide range of other features, such as peer-to-peer payments, bill splitting, and cryptocurrency trading.

Bottomline

Creating a Cash Advance App like Dave is a thrilling journey full of potential and challenges. But with a strong vision, a deep understanding of the market, and a talented team, you will have the ability to develop an app that not only empowers people to take control of their finances but also brings financial security and peace of mind to their lives.

What is Cash App?

Cash Advance App is a mobile payment service that allows users to send and receive money through their mobile devices. It was created by Square Inc.

Is Cash App safe?

Cash Advance App uses encryption and other security measures to protect your account and transactions. However, as with any financial service, it is important to take steps to secure your account, such as using a strong password and enabling two-factor authentication.

How do I set up a Cash App account?

To set up a Cash App account, download the app and follow the prompts to create an account. You will need to provide your name, email address, and phone number. You may also need to provide additional information, such as your Social Security number, to verify your identity.

How do I add money to my Cash App account?

You can add money to your Cash App account by linking a bank account or debit card and transferring funds. You can also add money by receiving payments from other Cash App users.

Can I use Cash App to pay bills?

Yes, Cash App offers a feature called Cash App Pay that allows you to pay bills directly from your account.

Can I use Cash App internationally?

Cash App is only available in the United States and the United Kingdom. If you are in another country, you will not be able to use Cash App.

Are there fees for using Cash App?

Cash App charges a 3% fee for sending money using a credit card. There are no fees for sending money using a debit card or bank account.

How to see someone’s cash app history?

If you want to see someone’s Cash App history, you need to have access to their Cash App account. Once you have access, you can follow these steps:

- Open the Cash App on your mobile device.

- Tap on the profile icon in the top left corner.

- Scroll down and tap on “Personal.”

- Select “My Cash.”

- Scroll down to view the transaction history.

If you want to view someone else’s Cash App history, you will need to have their login credentials or ask them to show you their transaction history in the app. It is important to respect people’s privacy and only access their account with their permission.

Does McDonalds take cash app?

Yes, McDonald’s accepts Cash App as a form of payment, but this may vary depending on the location. To use Cash App at McDonald’s, you need to have a Cash App account and a linked debit card. When you place your order at McDonald’s, simply select Cash App as your payment method and follow the prompts in the app to complete the transaction. It is always a good idea to confirm with the McDonald’s location beforehand to make sure they accept Cash App.

How to transfer EBT to cash app?

It is not possible to transfer EBT (Electronic Benefits Transfer) funds directly to Cash App. EBT funds are typically used for government assistance programs such as SNAP (Supplemental Nutrition Assistance Program) and can only be used for certain purchases such as groceries.

However, you can use your EBT card to purchase eligible items at participating retailers and then transfer the funds from your debit card to your Cash App account. To do this, you need to link your EBT card to your Cash App account as a debit card. Here are the steps:

- Open the Cash App on your mobile device.

- Tap on the profile icon in the top left corner.

- Scroll down and tap on “Add Bank or Card.”

- Select “Add a Debit Card.”

- Enter the information for your EBT card, including the card number, expiration date, and CVV code.

- Follow the prompts to complete the verification process.

- Once your EBT card is linked to your Cash App account, you can transfer funds from your EBT card to your Cash App account by selecting “Add Cash” in the app and entering the amount you want to transfer.

It’s important to note that some retailers may not allow you to use your EBT card for cash back or to make purchases with a debit card. It’s always best to check with the retailer before attempting to use your EBT card for these purposes.

How to transfer money from direct express to cash app?

To transfer money from Direct Express to Cash App, you can link your Direct Express card to your Cash App account as a debit card. Here are the steps:

- Open the Cash App on your mobile device.

- Tap on the profile icon in the top left corner.

- Scroll down and tap on “Add Bank or Card.”

- Select “Add a Debit Card.”

- Enter the information for your Direct Express card, including the card number, expiration date, and CVV code.

- Follow the prompts to complete the verification process.

- Once your Direct Express card is linked to your Cash App account, you can transfer funds from your Direct Express card to your Cash App account by selecting “Add Cash” in the app and entering the amount you want to transfer.

It’s important to note that there may be limits on how much you can transfer from your Direct Express card to your Cash App account, and there may be fees associated with the transfer. It’s always best to check with Direct Express and Cash App to understand the fees and limits before attempting to transfer funds.

How to link cash app to Albert?

Albert is a personal finance app that allows you to manage your money and track your expenses. While you cannot directly link Cash App to Albert, you can manually add Cash App transactions to your Albert account to track your spending.

To manually add Cash App transactions to Albert, follow these steps:

- Open the Cash App on your mobile device.

- Tap on the transaction you want to add to Albert.

- Take a screenshot of the transaction by pressing the home button and the power button at the same time (on most iOS devices) or by pressing the volume down button and the power button at the same time (on most Android devices).

- Open the Albert app on your mobile device.

- Tap on the “+” icon to add a new transaction.

- Select “Manual Entry” and enter the details of the Cash App transaction, including the date, amount, and category.

- Upload the screenshot of the Cash App transaction as a receipt.

Repeat these steps for each Cash App transaction you want to track in Albert. While this may take some extra effort, it can help you get a more complete picture of your overall spending habits.

How to order food with cash app without card?

To order food with Cash App without a card, you need to have a Cash Card account or Cash App balance. Here are the steps:

- Open the Cash App on your mobile device.

- If you have a Cash Card, make sure it is activated and has funds available. If you do not have a Cash Card, make sure you have a Cash App balance with enough funds to cover your order.

- Find a food delivery service that accepts Cash App as a form of payment. Examples include DoorDash, Postmates, and Grubhub.

- Place your order through the food delivery service’s app or website and select Cash App as your payment method.

- Follow the prompts in the app to complete the transaction. You may need to enter your Cash App account information, such as your phone number or email address, to authorize the payment.

It’s important to note that not all food delivery services accept Cash App as a form of payment. It’s always best to check with the service beforehand to make sure they accept Cash App. Additionally, you may be charged additional fees or incur higher delivery costs when using Cash App as a payment method.

Does cash app borrow build credit?

No, Cash App Borrow does not directly build credit. Cash App Borrow is a short-term loan service offered by Cash App that allows users to borrow money for a fee. While borrowing money and paying it back on time can be a positive factor for your credit score, Cash App Borrow does not report to credit bureaus, so it does not directly impact your credit score.

However, if you do not repay your Cash App Borrow loan on time, it could negatively impact your credit score. If your loan is sent to a collection agency, it could appear on your credit report as a delinquent account, which could lower your credit score. Therefore, it’s important to borrow responsibly and only borrow what you can afford to repay on time to avoid any negative impact on your credit score.

How to remove family account on cash app?

To remove a family account on Cash App, follow these steps:

- Open the Cash App on your mobile device.

- Tap on the profile icon in the top left corner.

- Scroll down and select “Invite Friends, Get $5.”

- Tap on the family member’s name you want to remove.

- Select “Remove” at the bottom of the screen.

- Confirm that you want to remove the family member’s account.

Once you have confirmed the removal, the family member’s account will be removed from your Cash App account, and they will no longer have access to any funds or features associated with your account.

If the family member you want to remove has sent or received money through your account, you may need to request that they return the funds before you can remove their account. If you have any trouble removing a family member’s account, you can contact Cash App support for assistance.

Why doesn’t my cash app have the paper money option?

The Cash Advance App paper money option, also known as Cash App Investing, may not be available to you for a few different reasons:

- Geographic Restrictions: Cash App Investing is currently only available in certain geographic locations, such as the United States. If you are not located in a supported location, you will not see the option to use Cash App Investing.

- Age Limitations: Cash App Investing is only available to users who are at least 18 years old. If you are under 18, you will not see the option to use Cash App Investing.

- Account Verification: To use Cash App Investing, you need to have a verified Cash App account. If your account has not been verified, you may not see the option to use Cash App Investing.

- Device Compatibility: Cash App Investing requires a compatible device and operating system to function properly. If your device or operating system is not compatible with Cash App Investing, you may not see the option to use it.

If you believe you meet all of the requirements and are still not seeing the Cash App Investing option, you may want to contact Cash App support for assistance.