Last updated on April 17th, 2023 at 05:18 PM

Digital wallets are increasingly popular because of the ease with which they may be used in today’s fast-paced world. It’s now possible to make purchases, send money to others, and monitor your spending with nothing more than a smartphone and a few clicks. But, not every digital wallet app is the same. A top-notch eWallet app will put the user’s requirements first and provide them with a variety of ways to pay. eWallet app development is receiving a lot of attention from both businesses and consumers due to the growing acceptance of digital payments and the proliferation of mobile devices. As a business owner, you may use eWallet apps to improve your payment processing, and as a consumer, you can use them to make your payments more convenient and safe. In this blog, we will delve into the fascinating realm of eWallet mobile app development, and learn all about these revolutionary new forms of digital payment.

1. Different Transaction Methods Available In A Digital Payments App

1. Bank Transfers

Transferring funds via one’s bank is a common way to make and receive payments. Digital payment apps require the user to submit the recipient’s bank account and routing information in order to complete a bank transfer. Based on the application and the nature of the transfer, sending money between bank accounts may be free or carry a nominal fee.

2. Credit or Debit Card Payments

Digital payment apps typically accept payments made via credit or debit card because it is a convenient and widely used means of payment. A user can pay with a credit or debit card linked to their account within the app by selecting that option during checkout. It’s possible to use some applications to safely save your credit card details for future purchases.

3. Mobile Wallet Payments

A mobile wallet is a feature offered by several digital payment apps that allow users to keep and access a sum of money for use in a variety of purchases. Wallets are digital accounts that allow users to save and spend money obtained from a variety of sources, such as direct bank transfers, credit/debit cards, and more. Mobile wallets may also include additional functionalities, such as the possibility of earning incentives or store loyalty cards.

4. Peer-to-Peer Payments

Anyone can use peer-to-peer (P2P) payments to send and receive money directly without any middlemen involved. P2P transactions are commonly used to divide up small purchases, pay back friends and family, and split expenses. Using a digital payment application, a user can send money to another person by simply entering the amount they wish to send, the recipient’s contact information or email address, and tapping a button.

5. Contactless Payments

Using a digital payment application for contactless payment is a fast and convenient method of purchasing products and services. With the use of NFC (near-field communication) technology, users may make contactless payments simply by touching their device against a payment terminal. Contactless payments are frequently utilized in brick-and-mortar shops and eateries, and they can expedite the checkout process.

6. Online Payments

There are a plethora of digital payment apps out there that enable consumers to make purchases and pay bills online. The standard procedure for making an online purchase is for the customer to enter their payment details (credit card number, expiration date, or mobile wallet balance) and then confirm the purchase.

7. Cryptocurrency Payments

A growing number of digital wallets now support cryptocurrency payments like Bitcoin, Ethereum, and Litecoin. Bypassing the requirement for a third party like a bank, cryptocurrency payments are instant, foolproof, and decentralized. Users can send cryptocurrency to another user by sending funds to their digital wallet address.

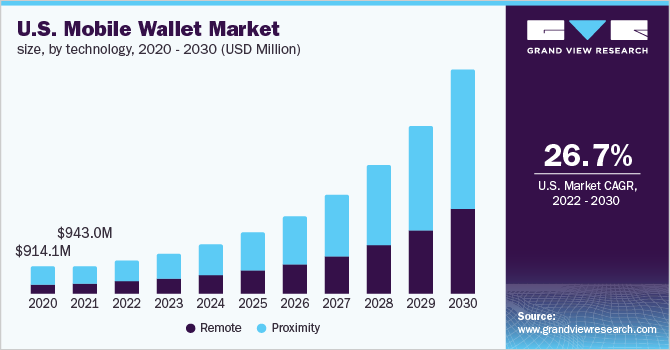

2. Why Develop eWallet Mobile app – Market Size and Statistics

Given the massive size and growth potential of the eWallet sector, the development of a mobile app for the service represents a rich business opportunity. The following market data illustrate why it’s crucial to create an eWallet mobile app:

- According to a report by Allied Market Research, the global mobile payment market is expected to reach $12.06 trillion by 2027, growing at a CAGR of 30.1%.

- The adoption of eWallets is rapidly increasing, especially among younger generations. The majority of millennials (77%) now prefer to make purchases with their smartphones rather than their traditional wallets.

- The convenience and security offered by eWallets have made them popular in developing countries where traditional banking services are limited. Over 1.31 billion people throughout the world are predicted to utilize mobile payment services by 2023.

- The e-commerce industry is also growing rapidly, and eWallets are becoming an essential payment method for online transactions. By 2025, 52.5% of all e-commerce sales will be paid for with digital wallets.

These numbers demonstrate the fast-expanding potential of the industry for mobile wallet app development. Many users, particularly younger ones, favor using eWallets as a payment option due to their simplicity, security, and adaptability.

3. What Is eWallet and How Does It Work?

When you create an eWallet account, you’ll likely be asked to connect it to a payment method. This could be a bank account or a credit or debit card. Once you’ve connected your eWallet to your payment method, you may use it to buy things and send money to other people right from the application. While using an eWallet that supports peer-to-peer payments, you can transfer funds to another user’s wallet.

It’s easy to pay using an eWallet mobile app; at checkout, just choose that option and enter the amount you wish to pay. After that, the app will use the data you entered to safely perform the transaction. Certain eWallets offer contactless payments, allowing you to make purchases by touching your mobile against a contactless payment machine.

To keep your information safe, eWallets implement several layers of security, such as encryption, tokenization, and two-factor authentication. Data encryption prevents unauthorized access to critical information like credit card numbers, and data tokenization makes it impossible for a hacker to use a stolen token to impersonate you online. Passwords, fingerprints, and facial recognition are all examples of single-factor authentication methods that can be supplemented by two-factor authentication to increase security.

Several eWallets allow you to do more than just make payments; they also give you tools to better manage your money, such tracking your spending and getting notifications when you reach certain thresholds. Using an eWallet that provides discounts, cash-back incentives, or prizes might be a great way to save money.

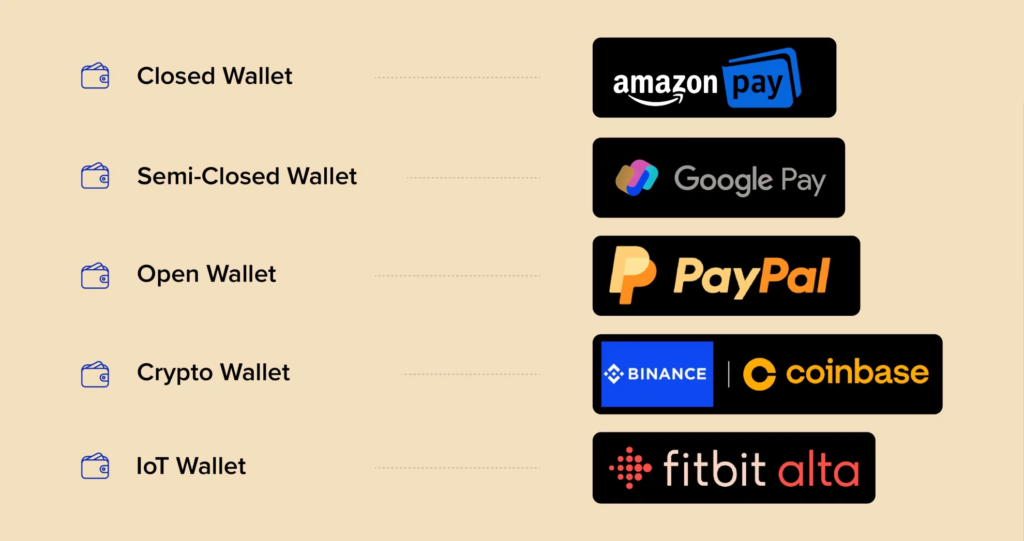

4. Types of Mobile eWallet Applications

1. Closed eWallets

The purpose of a closed eWallet is to facilitate transactions between customers and a single business or store. They are commonly used for buying and selling among participants in the same system. For instance, the Starbucks mobile app functions as a closed eWallet, allowing users to pay for purchases and accumulate rewards points without sharing any financial information with third parties. Businesses benefit from using eWallets because they make it easier to keep in touch with customers and gather data about their buying habits.

2. Semi-Closed eWallets

Similar to closed eWallets, semi-closed eWallets are built for use within a certain ecosystem, but users can still access their funds and make purchases from businesses outside of that area. In India, for instance, there is a semi-closed eWallet called Paytm that can be used to buy things, pay bills, and send money to other Paytm users.

3. Open eWallets

Open eWallets are compatible with several service providers and retailers, giving their users greater freedom and acceptance. The convenience of being able to store many forms of payment (such bank accounts and credit/debit cards) in a single location has made them widely utilized for both online and in-store transactions. PayPal, Google Wallet, and Apple Pay are all examples of open eWallets.

4. Credit Card eWallets

One subset of mobile eWallets, “credit card eWallets” are made exclusively for the purpose of managing one’s credit card details. Users can use the application to pay bills, check their balance, and review past transactions after linking their credit card information. Citi Wallet and Capital One Wallet are two examples of eWallets that can be used in conjunction with credit cards.

5. Cryptocurrency eWallets

Cryptocurrency eWallets are digital storage solutions for cryptocurrencies like Bitcoin and Ethereum. They provide extra layers of protection, such as two-factor authentication and encrypted storage, for users to keep their digital currency safe while sending, receiving, and storing it. Coinbase and MyEtherWallet are two examples of digital currency wallets.

6. Mobile Banking eWallets

Mobile banking eWallets are provided by conventional banks and other financial organizations. Users may access their bank accounts, make transfers, pay bills, and use other financial services all from their smartphones with the help of these eWallets. Chase Mobile and Bank of America Mobile Banking are two popular examples of mobile banking eWallets.

5. Features To Include In eWallet Apps

1. Easy User Registration

Any eWallet app must have a straightforward and user-friendly registration process. The account creation procedure for users should be simple, requiring only a few clicks and no additional steps beyond the standard set of verification questions.

2. Easy Navigation

An eWallet app’s user interface should be simplistic, with basic menus that provide quick access to the most important functionalities. The application needs to be simple enough that even those who aren’t tech-savvy can use it.

3. Multiple Payment Options

Payment methods such as credit cards, debit cards, bank accounts, and others should be supported by an eWallet mobile application for maximum convenience. This will provide customers with more leeway in selecting a method of payment that suits their needs and raise the possibility that their payment will be accepted by more businesses.

4. Security

While digital wallet app development, safety should be your top priority. Encryption, two-factor authentication, and biometric authentication are just a few of the security measures that eWallet apps should use to safeguard their users’ money. These functionalities will help prevent illegal access to eWallet accounts and safeguard users’ financial information.

5. Transaction History

Users of an eWallet app should be able to quickly and easily examine their whole transaction history within the app. This will assist users in keeping track of their expenditures and ensuring that they adhere to their budget.

6. Bill Payment

Numerous eWallet apps now offer bill payment capabilities, allowing users to pay their bills directly from within the app. This function may be useful for people who like to keep track of their monthly expenses in one place.

7. Cardless ATM Withdrawals

Certain eWallet applications now enable users to withdraw cash from ATMs without a physical card. Those who prefer not to carry their cards around may like this feature.

8. NFC Payments

With Near Field Communication (NFC) payments, customers can simply tap their phones on checkout terminals to make purchases. This could be a convenient method of paying for smaller transactions.

9. P2P Transactions

It’s a good idea to incorporate peer-to-peer transfers into eWallet payment app development so that customers may send money to their loved ones without having to go through an intermediary service. This is a practical method for dividing up a bill or settling a debt with a friend.

10. In-App Virtual Assistant

The incorporation of in-app virtual assistants enables consumers to receive customized recommendations and assistance with their transactions. With the help of machine learning algorithms, these virtual assistants can gradually improve their recommendations based on the user’s past actions and preferences.

11. Support for Many Languages

E-wallet apps should include a plethora of language support to attract customers from all over the world. Increasing the app’s compatibility in this way will help it reach more users.

6. Mobile eWallet App Development: Step-by-Step Explanation

1. Define the App’s Objectives and Features

It’s crucial to outline the goals and features of an eWallet mobile application before you begin designing it. In this phase, you will investigate the market and determine the requirements of your target audience. When designing your app, it’s crucial to think about how you can set it apart from the rest of the pack. Among these features may be the option to link numerous bank accounts, biometric authentication, and the ability to save loyalty points. Focus on how your app will benefit the user and how they will interact with it.

2. Choose a Platform

Your app’s target market and the functionality you plan to include will determine the platform you choose. iOS and Android are the most widely used mobile operating systems, making them ideal for creating apps for smartphones.

3. Design the User Interface

When you create eWallet app, it is important to take into account the user interface (UI). It’s crucial to create a user interface that is intuitive and simple to use, as well as tailored to the specific requirements of the target audience. This phase entails conceptualizing the app’s overall look and feel, from the color palette to the fonts, as well as its features. The Interface needs to be simple and straightforward, with obvious instructions and visual clues. You can collect feedback from possible users on the app’s design by creating wireframes and mockups to establish the layout and functionality of the app.

4. Develop the App

After the app’s goals and features have been determined and the user interface has been designed, development may begin. This requires writing code and integrating an application’s features and capabilities. The app should be optimized for speed and efficiency using the most up-to-date programming languages and tools. Digital wallet development can be accelerated with the help of libraries and frameworks.

5. Test the App

There is no way to avoid testing while making a new product. This stage involves checking the app’s functionality and features on a variety of devices and in a variety of settings to verify it is ready for release. It’s a good idea to put the app through its trials with a panel of beta testers to gather feedback and discover any problems with the user interface or functionality. This information will help developers make the app better for its users.

6. Launch the App

The eWallet software should be released after all bugs have been fixed and testing is complete. Getting an app ready to submit to an app store means making sure it conforms to the store’s specifications and rules. If you want to get people to download ewallet app and start using it, you should market it on social media and other platforms.

7. Maintain and Update the App

Maintaining an app’s compatibility with current operating systems, bug fixes, and feature additions all fall under this category. Your digital wallet application should evolve alongside the demands of your consumers, therefore being abreast of the newest trends and technology in this space is essential. In the long run, this is what will make your payment app successful and keep your users interested.

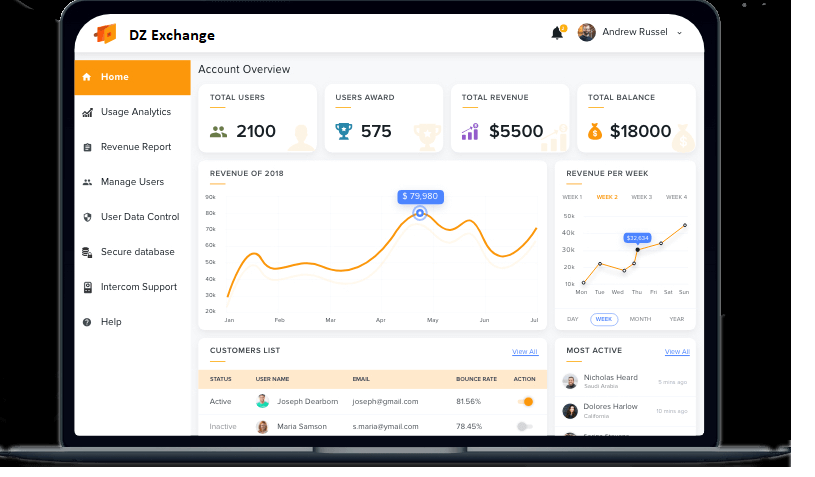

9. Monetization Opportunities Offered By eWallet Apps

- Transaction Fees

eWallet apps are typically monetized through transaction fees. Every time a customer uses the application to buy something, the company can tack on a little fee. You can choose a fixed charge or a percentage of the total as fee for this service. With the money made from the transactions, the app’s upkeep and development needs can be paid for.

2. Subscription Fees

Not only do e-wallet apps charge for each individual purchase, but they can also charge a membership fee for access to additional features or services. A premium app version may be made available by a company to provide more functionality, such as the capacity to save more cards or access to special promotions. By charging regular customers a subscription charge, businesses may generate a reliable revenue stream and give those customers access to exclusive features.

3. Advertising

Ads tailored to the demographics of the app’s users are another way that businesses can make money off of e-wallet apps. This can be accomplished through the use of in-app advertisements or through the formation of advertising partnerships. If the application has a huge user base, advertising may be an efficient way to make money. Nonetheless, it is essential to maintain a favorable user experience when displaying advertisements.

4. Partnerships and Sponsorships

For eWallet apps, this is arguably the most interesting and flexible way to make money. E-wallet applications can provide their users with exclusive content and attract advertisers by teaming up with other companies and brands. Partnerships and sponsorships can take many forms; for example, businesses might team up with banks to provide customers with special discounts and rewards or with stores or event organizers to provide customers with cash-back incentives and discounts.

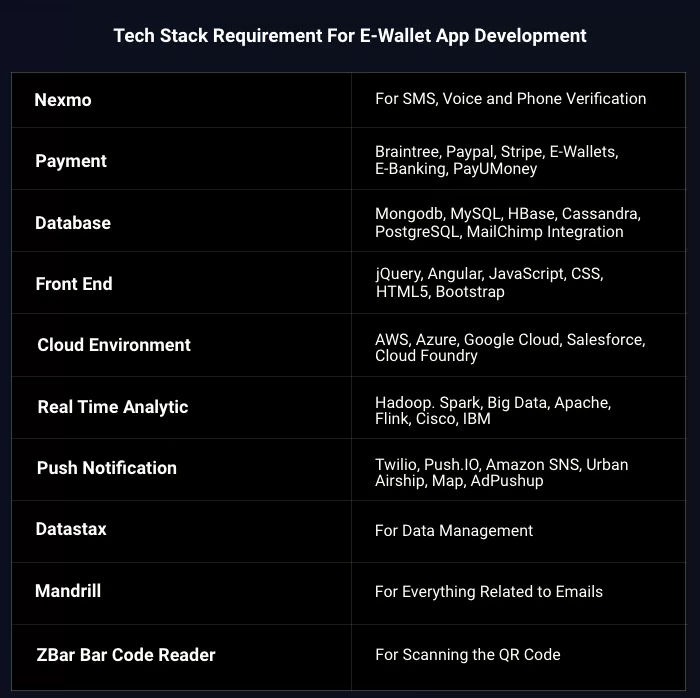

9. Tech Stack Required to Develop an e-Wallet Mobile App

To build a reliable and user-friendly eWallet mobile application, you need a comprehensive set of technologies. The following is a complete breakdown of the technology prerequisites for creating an eWallet mobile app:

- Programming Languages: Several programming languages, like Java, Kotlin, Swift, and React Native, may be used to create eWallet applications. Android apps are often written in Java, while iOS apps are written in Swift. In contrast, with React Native, you can write an app once and have it run on both Android and iOS.

- Development Frameworks: A development framework is a collection of resources that may be used to speed up the process of creating an app. Spring Boot, Laravel, and Ruby on Rails are three of the most popular frameworks for wallet app development.

- Payment Gateway Integration: Integrating a payment gateway is a critical step in building an eWallet application, and services like PayPal, Stripe, and Braintree are among the most widely utilized.

- Database Management Systems: Data storage and administration is the primary function of a database management system. MySQL, MongoDB, and Cassandra are only some of the most popular DBMSs for eWallet applications.

- Push Notifications: The most recent deals, offers, and discounts can be sent to users via push notifications. Services like Firebase Cloud Messaging and Apple’s Push Notification service allow for the seamless incorporation of push notifications.

- Cloud Service Providers: App hosting and data management are performed by third-party cloud service providers. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are all common cloud service providers for eWallet applications.

- Security Features: Keeping users’ private data safe is of paramount importance, making security a top priority during the creation of any eWallet program. Data encryption, SSL/TLS certificates, two-factor authentication, and biometric authentication are all good security features to implement.

10. How Much Does It Cost To Develop An eWallet App?

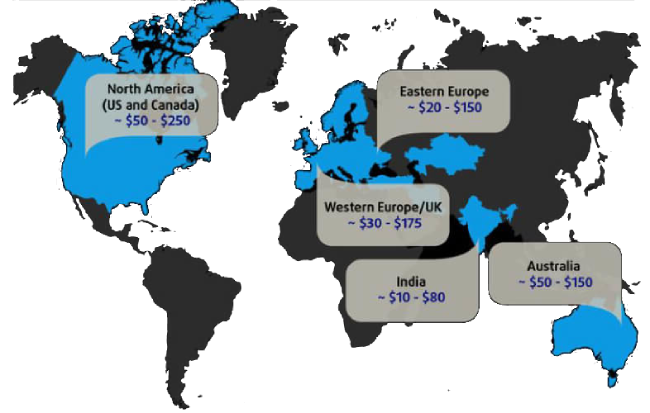

The cost to design an eWallet app varies based on a variety of criteria, including the app’s complexity, the number of features and functionalities, the location of the development team, and the amount of time needed to build the app. Yet, on average, the price tag for creating an eWallet application might be anywhere from $25,000 to $150,000. The eWallet cost breakdown can be as follows:

- App Design: Based on the features and customizations you require for your eWallet application, the price could range between $2,000 and $20,000.

- Front-end and Back-end Development: The cost of the front-end development phase can range from $5,000 to $40,000, while the cost of the back-end can be anywhere from $10,000 to $50,000.

- Testing and Deployment: Testing an eWallet app costs between $5,000 and $10,000, while deployment costs between $2,000 and $5,000, depending on its complexity and the number of required platforms.

- Maintenance and Upgrades: There is an annual cost of $3,000 to $15,000 to maintain and upgrade an eWallet app.

11. Conclusion

The success of a mobile eWallet application hinges on its ability to provide seamless transactions, dependable security features, and an intuitive UI. Furthermore, the future of eWallets appears boundless with the rise of digital currencies and blockchain technology. Mobile eWallet app developers, with the correct mindset and technology stack, may create groundbreaking apps that improve people’s relationships with money.