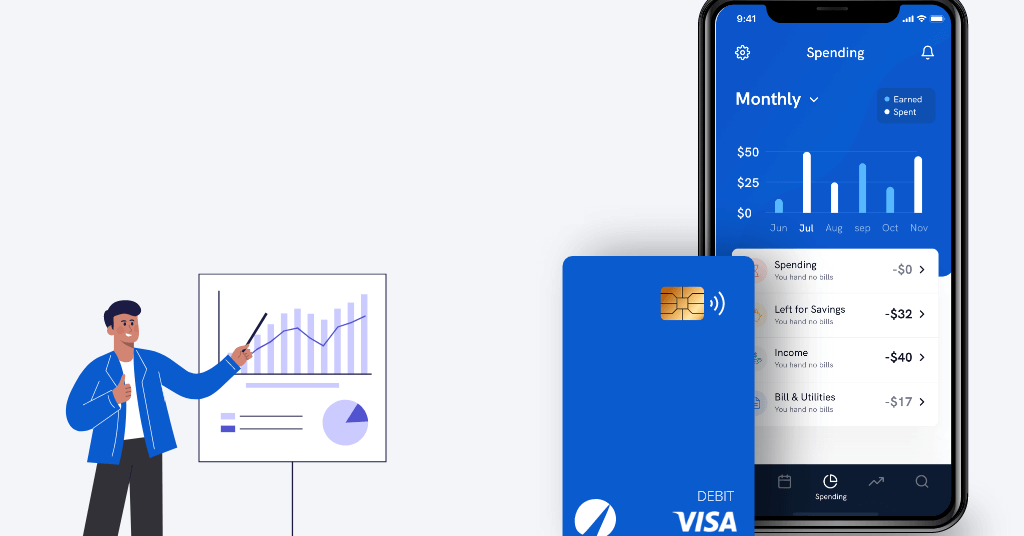

FinTech mobile applications have become the beating heart of the banking, finance, insurance, investing, and credit industries. Fintech app development has been the finest approach for financial firms to achieve swift success in recent years. The popularity of Fintech applications stems mostly from people’s shift to online services. People are adopting contactless payment systems and financial applications for everything from rapid money transfers and money loans to stock investing. build a fintech app banking applications provide more convenience, higher levels of security, faster credit approvals, and better customer care.

What Exactly Are FinTech Apps?

FinTech or Finance apps enable banks and finance firms to provide all financial services online. Finance apps assist businesses in providing online money transfer services, electronic transfers, exchanges, tracking personal finances and expenses, exchanging cryptocurrency transactions such as bitcoins and digital currencies, credit services, simulated auditing, quick billing, and a variety of other financial services. Fintech Apps enable finance organizations to provide all monetary services to end clients.

What Are the Different Kinds of FinTech Mobile Applications?

If you really are prepared to invest in FinTech App Development, you need first to understand your company specialty and the financial services you intend to digitize for your target audience.

Here are a few common FinTech applications that dominated the digital banking business in 2021 and will provide enormous prospects for banks and other payment organizations in 2022.

App for Payments

It is one of the places wherein Fintech has had an impact on mobile technology. Because we no more need to bring cash in our wallets, smartphone payment apps have become an essential part of our daily lives. The wallets app, which is used by millions of companies and individuals, is linked to several payment methods. What is it about them that makes them so famous? These provide a more convenient and secure payment mechanism, as well as a better consumer experience. Traditional payment mechanisms have been superseded by these mobile payment applications.

Apps for Finance

Consumer finance applications are designed to help people manage their money and make educated financial decisions. Customers may use this program to help them with planning, digital payment administration, credit card backup, and customer details analytics. This type of Fintech software benefits users by enhancing the user experience, reducing a barrier to operations above traditional banking systems, and cutting costs.

Apps for Investing

This type of app is a fantastic example of things to consider while searching for Fintech mobile app developers. Users can use investing programs to assess and then invest in a wide range of financial resources depending on their suitability. Customers profit from these technologies since they enable them to enhance their skills and invest through data analytics.

Apps for Insurance

Insurance solutions aid clients in acquiring accurate and up-to-date insurance information. These aid users in addressing issues that have emerged in the financial industry. Insurance is provided in many different industries, including claim settlement, sales & marketing, travel, automobile, and medical.

Apps for Lending

Peer-to-peer lending apps link users with people who want to borrow money or contribute money to someone in need without going via a government-regulated lender. These programs also allow consumers to borrow a little cash against their next payment.

We can incorporate the following functionalities in a financial app:

Account Administration

For customers, the app should be essential for identification, transactions, and day-end tally. It should assist the user with monthly installments, account records, and current accounts via the banking program. You may also access money transactions in a simple and secure manner. Account management options will be provided by the developer, such as money transfers via phone numbers or email accounts.

Options for Customization

There are several platforms in the market that provide the same tedious functionality in Android App Development. So, how can you make your software sound distinct? Customized Fintech App Development will have a large influence. Clients in the financial and banking industries decide whether or not to include specific features. It all starts when prospective clients approach software development firms with a range of issues. To solve these difficulties, technological solutions are being explored. Mobile App Developers may use IoT, machine learning, AI-powered bots, and other cutting-edge technology.

Analytics of Data

Fintech companies would never turn down the chance to study data and gain knowledge in order to deliver better financial advice to their clients. Data analytics is an essential element of fintech android or IOS App Development since it allows consumers to review and trace the history of their financial activity. In addition, the application analyzes the full data set and generates findings for the user. Using big data, customers may monitor and follow their previous financial activities.

FinTech App Development Tools and Technologies

Scripting languages, techniques, and Graphical User (UI) architectures will also be critical in the creation of robust and bug-free mobile apps on a tight budget.

Native Fintech App Tech Stack

Fintech applications for iOS or Finance software for Android are referred to as native applications since they are platform-specific. The usage of Objective C, SWIFT, Apple Xcode, and the iOS SDK is the ideal solution for developing native iOS apps. Use Java, Kotlin, Android Studio, and the Android SDK to create native Android apps.

Mobile applications that are cross-platform

Native, C #, and Flutter are commonly used in the creation of Fintech apps that operate flawlessly on both the Android and iOS platforms.

Now, let’s look at the cost of developing a FinTech app engine on its level of sophistication.

How Much Will a FinTech Solution Cost in 2022?

FinTech solutions for B2B and B2C satisfy the financial demands of enterprises and consumers. The pricing for your app will be determined by Mobile app development firms USA based on your app specifications. As the leading mobile application development firm, we predict that the cost of developing a FinTech app will be as follows.

- Developing a FinTech app with minimal capabilities for Android or iOS will vary between $25,000 and $40,000.

- Cost of developing a medium-level Fintech app incorporating AI technology and additional functionality will vary between $45,000 to $85,000.

- The cost of developing a fully comprehensive Fintech or financial app for Android and iOS platforms will exceed $100,000.

How Much Does It Cost to Keep a Fintech App Running?

In the banking industry, management and security are critical aspects. If you develop a FinTech app, you must keep it up to date on a regular basis. It will guarantee that no serious defects or security issues exist that might threaten the user’s money or bank banking information. Formerly, the cost of maintaining a simple app was low, but with cutting-edge innovations in the sector, its requirements are increasing.

Because a Fintech mobile application has numerous critical functions, the maintenance costs are high in order to guarantee a good, secure, and trustworthy User Experience. The lot of cash you spend on upkeep each year is determined by several factors. In a word, your yearly maintenance expenses will be decided by the number of users, the sophistication of your software, and the quantity of data you have access to.

Financial analytics of Fintech

Using data to provide a single perspective of all leased assets in real-time has never been more important, and financial sector firms are no exception. In an ever-competitive world, like today customers can go elsewhere to fulfill their requirements, and data-driven decisions by analytics are critical. With this in mind, we investigate the importance of data analytics in Fintech operations.

The current situation

Historically, financial services firms handled data in their own divisions, resulting in disjointed views of company development and client behavior. However, in today’s commercial environment, organizations can no longer afford to take this approach and require a unified picture to acquire meaningful insights.

According to current industry research, the worldwide financial analytics market would be worth $25.38 billion by 2028. The role of analytics becomes more significant in Fintech-powered operations. But complications persist in extracting insights from increasing volumes of data due to skill gaps afflicting tech in general. This may be minimized by forming strong alliances with suppliers such as cloud providers (CSPs) like AWS and Azure, which are constantly upgrading their analytics capabilities.

Processing increasing amounts of data

Democratization of the workforce is necessary to properly handle data in financial products. Assets cannot remain simple with conventionally competent IT professionals.

“Whether it’s finding Alpha, managing risk, maintaining compliance, or spotting fraud, the finance sector has always been at the vanguard of data analytics,” said James Corcoran, senior vice president of consumer value at KX. “Today’s difficulty for financial services organizations is that there is simply too much data to analyze intuitively and without assistance.” Insights are no longer obvious; they must be mined and mined fast before a problem or an opportunity arises.

Additionally, the disruption caused by the pandemic, a more complicated regulatory framework, and the unrelenting influence of digitalization on the industry, make the emphasis on the management and analysis of data stronger. At KX, The challenge for financial services firms today is that there has been simply too much data to examine intuitively and without help. “Insights are no longer clear; they must be mined quickly before a problem or opportunity develops.”

Board-level analytics

To generate that critical business value involvement of board leadership in the vision is a must. After this, boardrooms in financial services may utilize intelligence to measure data-driven choices that influence the company’s bottom line.

Data, which was formerly considered an IT issue, should now be at the core of business concepts and plans.” Board level decisions must be based on factual insights rather than outdated methodologies that are no longer relevant in today’s climate,” highlighted Anurag Bhatia, senior vice president and head of Europe at Emphasis.

“The first step for managers in harnessing innovation and monetizing their data is to instill the necessary digital infrastructure to reduce silos and make excellent data more accessible.” The cloud is a key facilitator here, allowing for continual innovation and allowing for the deployment of powerful AI and machine learning technologies for optimal data analytics.

Executives who have a total view of their data may not only use it to generate valuable insights but can also more easily adapt to a changing regulatory landscape.

The Success of FinTech Depends on Better Analytics

Fintechs have enjoyed a surge, unlike any other business in recent years. There has been an infusion of big investments as a result of field accelerations. According to CBI Insights, the globe has 1,021 unicorn firms (private companies valued at more than $1 billion) with a total worth of $3.3 trillion.

Fintech is interesting not only for industry professionals but also for regular customers. Consumers may now receive real-time solutions through financial products and other business-related challenges. Fintech, like any other, quickly developing business, is constantly reinventing itself, with game-changing breakthroughs appearing multiple times a year.

As a result, competition in the sector has intensified, forcing current major companies to pursue ideas they previously did not contemplate. According to PWC, 77 percent of financial institutions may expand their attention on innovation in order to retain customers.

In fintech, data analytics creates the groundwork for a company’s understanding of its clients. Analytics provide information about client behavior, demands, and expectations. The more a fintech company (or any company) understands its consumers, the deeper it can offer them tailored solutions. Analytics is the crutch of modern companies, and hence the key to better service and growth.

Data analytics may also assist fintech businesses in providing products and services that are more appealing to a wider audience. Banks and financial organizations have access to massive client data sets, but in the age of big data, they frequently fail to effectively use the value of these insights.

Fintech firms have discovered what the analytics sector can do when company operations use deep learning skills. Understanding their consumers and making swift decisions that benefit them with these digital technologies in play gives these new businesses significant benefits over conventional financial institutions.

Understanding Analytics Is the Fintech Future

The estimation of the worldwide big data market is around $274.3 billion in 2022. And this worth tends to rise dramatically in the future due to global internet users generating almost 2.5 quintillion bytes of data per day.

Data empowers firms to make more informed decisions and increase revenue creation. Companies can stay competitive, produce better goods and services, enhance customer happiness, and drive innovation by effectively tracking, collecting, and evaluating meaningful, data-driven insights. Key stakeholders in the financial business may use analytics to:

Make Informed Choices:

Fintech firms may utilize data to analyze customer behavior and then act on it. Fintech companies may make better-informed judgments about what goods and services to provide and how to promote them to clients as a result.

Income Generation:

Fintech businesses may utilize big data to uncover new revenue prospects. They can also monitor client purchasing habits to determine which items or solutions are most tempting to them. The use of data enhances productivity and revenue.

Improve Operational Efficiency:

By taking necessary actions on data acquired from various sources, the underlying mechanism of most workplace processes may be enhanced. Data analytics may help fintech businesses find inefficiencies and improve their operations.

Improve Marketing:

Analytics may assist organizations in determining which marketing activities are effective and which should be modified or discarded entirely. Data is used by fintech organizations to identify consumer categories. Analyze their needs, and create focused marketing efforts across numerous platforms.

Identify Trends/Frauds:

Trend identification is heavily reliant on data analytics. Which fintech businesses may use to stay one step ahead of their competitors. Similarly, analytics’ fraud and risk detection skills can assist fintech financing.

Reduce Business Hazards and Financial Waste:

Financial waste happens when businesses make poor judgments. Businesses that lack knowledge frequently fall behind their competition. Meanwhile, in the financial realm, data-driven decisions may assist prevent company dangers and eliminating resource waste.

Endnote

Mobile banking applications provide more convenience, higher levels of security, faster credit approvals, and better customer care. Fintech apps enable banks and finance firms to provide all financial services online. Here are a few common FinTech applications that will dominate the digital banking business in 2021. Customers profit from these technologies since they enable them to enhance their skills and invest through data analytics. The inclusion of features has a large influence on Customized Fintech App Development.

The cost of developing a FinTech app with minimal capabilities for Android or iOS will vary between $25,000 and $40,000. Scripting languages, techniques, and Graphical User (UI) architectures. Will also be critical in the creation of robust and bug-free mobile apps. How much does it cost to maintain a Fintech app? Maintenance costs are high in order to guarantee a good, secure, and trustworthy User Experience. The number of users, the sophistication of your software, and the quantity of data you have access to determine the cost.