Venmo is a popular peer-to-peer payment app that has taken the world by storm. It allows users to easily transfer money to one another, either as a gift or to settle a debt. With its user-friendly interface, Venmo has become a go-to app for people who want to send and receive money quickly and efficiently. How does Venmo work and makes money?

In this blog, we will explore the ins and outs of Venmo and shed some light on its business model. Whether you’re a seasoned Venmo user or just curious about the app, this post is for you!

What is Venmo App?

Venmo is a mobile app that enables users to send and receive money from friends and family. It allows users to connect their bank account or credit card to the app and then easily transfer funds to others who also have the app. Venmo also has a social aspect to it, as users can see a feed of their friends’ transactions and add comments or emojis to them. Venmo is widely used as a simple and convenient way to transfer money, and it has become particularly popular among younger generations.

How does Venmo work?

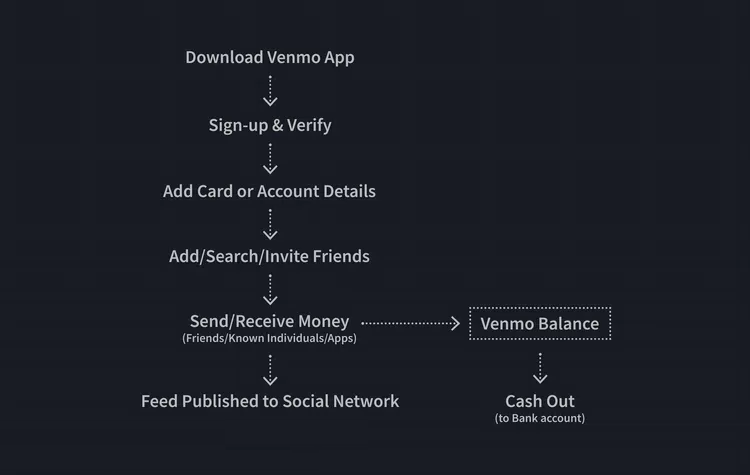

Venmo is a peer-to-peer payment app that allows users to send and receive money from one another quickly and easily. Here’s how does Venmo work:

- Sign up: To use Venmo, you first need to sign up for an account using your email address or phone number.

- Connect a bank account or credit card: You can then connect a bank account or credit card to your Venmo account, which you can use to send and receive payments.

- Send or receive payments: To send money, simply enter the amount you want to send and the recipient’s Venmo username. You can also add a message or emoji to personalize the transaction. The recipient will receive a notification and can either accept or reject the payment. To receive money, you simply need to have a Venmo account and provide your Venmo username to the sender.

- Instant transfer: Venmo offers an instant transfer option, which allows you to transfer funds from your Venmo balance to your linked bank account. This transfer typically takes just a few minutes.

- Security: Venmo uses encryption and multiple layers of security to protect your personal and financial information, ensuring that your transactions are secure.

By using Venmo, you can quickly and easily send and receive payments from friends, family, and other contacts, without having to worry about cash or check transactions. Whether you’re splitting a dinner bill or paying back a friend for concert tickets, Venmo makes it easy and convenient.

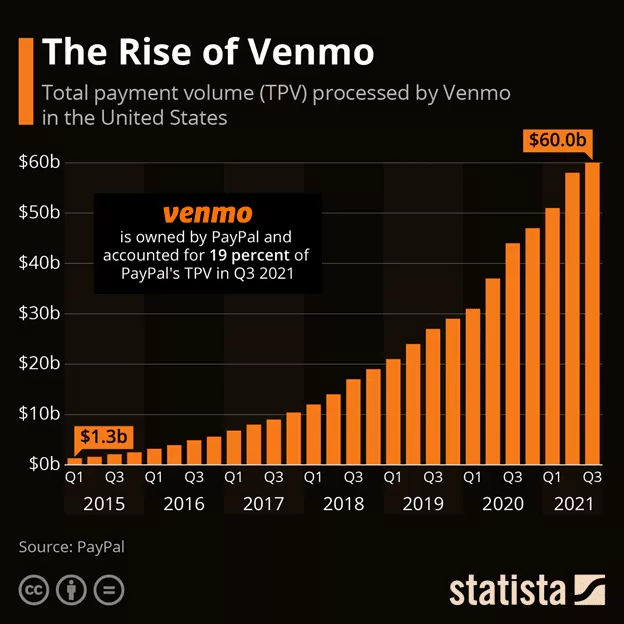

Here are some Statistics on Venmo:

- User base: As of 2022, Venmo had over 77.7 million active users in the United States.

- Transactions: In the fourth quarter of 2022, Venmo processed over $44 billion in total payment volume.

- Age demographic: Venmo has a strong appeal among younger users, with 70% of its users being under the age of 35.

- Revenue: Venmo generated revenue of over $300 million in 2021, primarily through its transaction fees and payment processing services.

- Popularity: Venmo is consistently ranked among the top finance apps in both the Apple App Store and Google Play Store.

These statistics demonstrate the widespread popularity and usage of Venmo as a convenient and efficient way to transfer money between individuals.

What are Various Revenue Models of Venmo App?

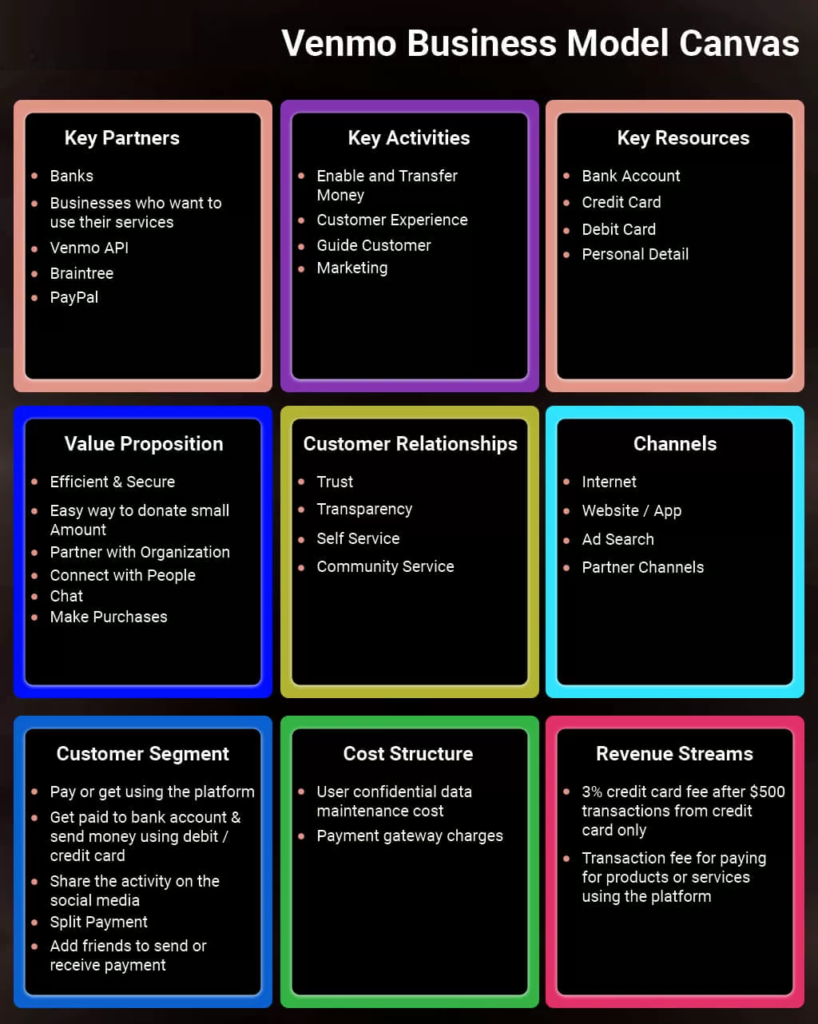

Venmo generates revenue through a few different channels:

- Transaction fees: Venmo charges a fee for instant transfers to a debit card, typically 1% of the transaction amount with a minimum fee of $0.25 and a maximum of $10.

- Payment processing: Venmo also makes money by offering payment processing services to merchants. This allows businesses to accept Venmo as a form of payment, and Venmo charges merchants a fee for this service.

- Interest on Venmo balances: Venmo also earns interest on the funds that are held in users’ Venmo balances, which are insured by the FDIC.

- Advertising: Venmo also generates revenue through targeted advertising, where brands can reach out to users within the app.

By utilizing a combination of these revenue streams, Venmo is able to offer its services to users for free while still generating significant revenue for the company.

Let’s discuss each of these revenue models in detail:

1. Transaction fees

The first Venmo revenue model is transaction fees. Venmo charges a fee for instant transfers to a debit card, typically 1% of the transaction amount with a minimum fee of $0.25 and a maximum of $10. This fee is charged to cover the cost of processing the transaction and making the funds available instantly.

For example, if you want to transfer $100 to your debit card instantly, Venmo would charge you a fee of $1, as it is less than the maximum fee of $10. This fee is automatically deducted from the amount you are transferring, and the remaining funds will be available on your debit card.

The transaction fee for instant transfers is optional, and users can also choose to transfer funds for free, but with a delay of 1-3 business days for the funds to become available on their debit card.

2. Payment processing

Venmo offers payment processing services to merchants, which allows them to accept Venmo as a form of payment. When a customer uses Venmo to make a purchase from a participating merchant, Venmo charges the merchant a fee for processing the transaction.

The fee for payment processing varies depending on the type of transaction, but typically ranges from 2.9% + $0.30 to 3.5% + $0.15 per transaction. This fee covers the cost of processing the transaction, protecting against fraud, and providing customer support.

By offering payment processing services, Venmo is able to expand its reach beyond just peer-to-peer payments and into the larger world of commerce. This opens up new revenue streams for the company and increases the value of the service for users, who can now use Venmo for transferring and accepting payments.

3. Interest on Venmo balances

The next Venmo revenue model refers to interest on Venmo balances. Venmo earns interest on the funds that are held in users’ Venmo balances, which are insured by the FDIC.

When a user receives money through Venmo, the funds are held in their Venmo balance until they withdraw them to their linked bank account or spend them through the app. Venmo earns interest on the funds held in these balances, and this interest serves as a source of revenue for the company.

It’s important to note that the interest earned on Venmo balances is likely to be relatively low, as the balances are typically held for short periods of time. However, the large volume of transactions processed by Venmo means that even a small amount of interest earned on each transaction can add up to a significant source of revenue for the company.

4. Advertising

The final Venmo revenue model refers to advertising. Venmo generates revenue through targeted advertising, where brands can reach out to users within the app.

Venmo has a large user base and a high level of engagement, which makes it an attractive platform for advertisers. Brands can target specific demographics or interests and deliver advertisements to users within the app, such as in the transaction feed or on the home screen.

By offering targeted advertising, Venmo is able to generate additional revenue while providing value to users by connecting them with relevant products and services. The revenue generated from advertising is likely to be relatively small compared to other revenue streams, such as transaction fees and payment processing, but it still serves as an important source of revenue for the company.

How to Make an App Like Venmo?

If you want to create an app like Venmo, you will need to follow these steps:

- Conduct market research: Study the current market and analyze the competition to understand what makes Venmo unique and what opportunities exist for a similar app.

- Define your target audience: Identify the demographics and interests of the users you want to target with your app.

- Create a business plan: Outline the goals, target market, marketing strategy, revenue streams, and budget for your app.

- Design a user-friendly interface: Develop a user-friendly interface that is easy to navigate and allows users to easily send and receive payments.

- Integrate payment processing: Integrate a payment processing system into your app to allow users to send and receive payments.

- Implement security features: Ensure that your app is secure by implementing features such as encryption, two-factor authentication, and fraud protection.

- Launch and market your app: Launch your app and promote it through social media, influencer marketing, and other channels to reach your target audience.

- Continuously improve and update the app: Monitor user feedback and continuously improve and update the app to provide the best possible experience for users.

Creating an app like Venmo requires a significant investment of time and resources, but if done correctly, it has the potential to be a profitable and successful business. It’s important to understand the market, target audience, and revenue streams to ensure the success of the app.

How Much Does it Cost to Develop an App like Venmo?

The cost of developing an app like Venmo can vary greatly depending on several factors, such as the complexity of the app, the experience and expertise of the development team, and the region where the development is taking place.

On average, the cost of developing an app like Venmo can range from $50,000 to $300,000 or more. This includes the cost of design, development, testing, and launch.

It’s important to understand that developing an app like Venmo requires a significant investment of time and resources, and it’s essential to work with a team of experienced and skilled developers to ensure that the app is of high quality and meets the needs of users.

Additionally, ongoing costs such as marketing, maintenance, and updates must also be considered when estimating the total cost of developing an app like Venmo.

It’s recommended to work with a development team or agency to get a more accurate estimate for the cost of developing an app like Venmo based on your specific requirements and goals.

What Team Composition is Required to Build an App like Venmo?

To build an app like Venmo, you will need a development team that includes the following roles:

- Project Manager: Manages the project, coordinates with the development team, and ensures that the app is developed on time and within budget.

- Designer: Creates the user interface, designs the user experience, and ensures that the app is visually appealing and easy to use.

- Back-end Developer: Develops the server-side infrastructure and the database, ensuring that the app is secure and can handle high volumes of transactions.

- Front-end Developer: Develops the user-facing side of the app, ensuring that it is responsive and provides a seamless experience for users.

- Payment Processing Expert: Implements and integrates the payment processing system into the app, ensuring that payments are secure and compliant with industry standards.

- QA Tester: Tests the app to ensure that it is functioning correctly and that it meets the needs of users.

- Marketing Specialist: Develops and implements a marketing strategy to promote the app and reach its target audience.

It’s important to have a balanced and experienced team with expertise in all the key areas of app development to ensure that the app is of high quality and meets the needs of users. You may also consider working with a development agency or outsourcing some roles, depending on your specific requirements and budget.

What Technology Stack is Required to Build an App like Venmo?

The technology stack required to build an app like Venmo includes the following:

- Front-end development: React Native, AngularJS, or similar front-end frameworks can be used to develop the user-facing side of the app.

- Back-end development: Node.js, Ruby on Rails, or similar back-end frameworks can be used to develop the server-side infrastructure and database.

- Database management: MongoDB, MySQL, or similar databases can be used to store and manage the data for the app.

- Payment processing: Stripe, PayPal, or similar payment processing systems can be integrated into the app to allow for secure and compliant payment processing.

- Cloud infrastructure: Amazon Web Services (AWS), Google Cloud, or similar cloud platforms can be used to host the app and ensure scalability and reliability.

- Security: SSL encryption, two-factor authentication, and other security measures should be implemented to ensure the security of user data and transactions.

It’s important to use modern, reliable, and secure technologies to build an app like Venmo, as this will ensure that the app is scalable, reliable, and secure and that it meets the needs of users. Additionally, it’s essential to continually monitor and update the technology stack to ensure that the app stays up-to-date with the latest trends and technologies.

Why Hire Exato Software to Build an App like Venmo?

Here are the benefits of hiring Exato Software to build an app like Venmo:

- Experience and Expertise: Exato Software has extensive experience in building and launching successful financial apps, including apps similar to Venmo. This expertise ensures that the app will be developed to a high standard and will meet the needs of users.

- Customizable Solutions: Exato Software provides customizable solutions, ensuring that the app will be tailored to your specific requirements and goals.

- Agile Development Methodology: Exato Software uses an agile development methodology, which means that the development process is flexible, efficient, and responsive to changing requirements.

- Time-to-Market: Exato Software has a proven track record of delivering projects on time and within budget, ensuring that your app will be launched as quickly as possible.

- 24/7 Support: Exato Software provides 24/7 support, ensuring that any issues or problems are resolved quickly and effectively.

- Cost-effective: Exato Software provides competitive pricing and flexible engagement models, ensuring that you get value for money.

By hiring Exato Software to build an app like Venmo, you can benefit from their expertise, experience, and commitment to delivering high-quality, cost-effective solutions.

Conclusion

In conclusion, Venmo is a popular peer-to-peer payment app that has revolutionized the way people make and receive payments. It operates on a revenue model that includes fees for instant transfers, credit card transactions, and business payments.

To build an app like Venmo, you will need a development team that includes roles such as project manager, designer, back-end developer, front-end developer, payment processing expert, QA tester, and marketing specialist. The technology stack required for an app like Venmo includes front-end and back-end development frameworks, a database management system, a payment processing system, and cloud infrastructure.

Exato Software is a company that has the experience and expertise to build a high-quality app like Venmo, with customizable solutions, an agile development methodology, quick time-to-market, 24/7 support, and cost-effective pricing. Contact us today to turn your financial app idea into a profitable business.