It has never been easy to comprehend the financial world regarding using services or understanding their employability. However, the growth of Fintech app development has emerged as a key factor in ending these complexities.

It supports the concerns about providing the highest security, dependability, and stability to businesses operating in the segment. It has made comprehending these realms much simpler and easier. You now have access to more secure and convenient ways to use banking services across a variety of industries.

Now, if you are planning to proceed with a fintech application development endeavour, you are required to have some meticulous planning and an actionable roadmap in hand. Let’s move on to some advice for understanding what fintech application development is all about.

What is a Fintech Application

We refer to finance technology as fintech which is based on the mobile and web applications. Now if we talk about what these applications really do, then they perform on a certain set of functions and add to the optimization and ease of using financial services. This is because dealing with money matters can occasionally be overly taxing. This application has the benefit of providing simple-to-use software solutions and a management system for managing financial operations.

Fintech Application Development for a Booming Market

When you hire professionals for developing the fintech app it becomes ten times more accurate and lucrative.

Some of the expert steps undertaken in the process include:

1. Who is your intended audience?

You gain insight into the requirements of your customers when you hire the services of a fintech application development company. Here, you need to look for the customer’s requirements based on their desire as to what they really are expecting in terms of service and output. This way you can approach them in more of a customized way offering uniqueness in your solution.

2. Features

When you lay your focus on hiring top-notch fintech app developers, they ease the entire task for you right from bringing seamless programming langauge adoption to making the appproriate technology selections. Also, their laser like focus and forward loking approach lets you have an application of enhanced potential.

3. Observing industry patterns

Knowing what your competitors are doing is always the best course of action. Look at the applications being in place which are produced by your competitors. Know what they are adding in terms of features for ranking higher.

4. Make ongoing endeavours to enhance the customer experience

Create a user interface that is easy to use to improve the client experience. It ought to be effective and profitable in every field. Try to make the UI interactive and smooth for user experience, from simplicity to utilisation, to provide a more appealing view.

5. Security needs to come first.

Moving forward with the concept of application development with security is simply possible. It requires top importance from you. When conducting delicate business, such as financial transactions, it is crucial to consider factors like security and legal compliance. Hire fintech app development companies to simplify everything for you by streamlining the processes.

6. Greater scaling

As you learn about every little detail of developing a fintech app, such as the fintech app development cost, keep an eye out for future possibilities. Create a product which holds the ability to cater to the needs of huge sets of people.

If you want to create an application, then you should be prepared with an exceptionally performing strategy in hand. You must take care of every detail, from balanced technology to legal conformance and user experience. Make a product that has a lot of worth.

Monetizing Your Fintech Application

To some extent, making money from your Fintech application can be difficult. Your motivations for generating revenue must be clearly outlined when developing Fintech applications. However, the correct fintech application development services can offer numerous ways to monetize application development. These techniques include:

1. No-cost versions

You can provide a free introductory edition of your application. You can make it necessary for users to subscribe to the premium edition in order to access more sophisticated features and functionalities.

2. Publicity

Displaying advertisements within your applications is another way to monetize them and earn money. You can make money from your sponsors in this way.

3. Referrals

You can also collaborate or partner with other companies, financial institutions, or both. You’ll be paid a small commission for each customer who decides to recommend and use your services.

4. Subscriptions

Additionally, you can charge users a recurring fee to use your application and its functions on a regular basis.

5. Transactional Model

Every transaction or financial service your users use and carry out through your application can be charged for.

6. Data evaluation

By gathering and examining the data that is being gathered from your application, you can also gain insight into the charging pattern.

Your target market and the level of market rivalry would directly impact the monetization strategy you would select for the fintech app development services. Ensuring that the user experience is improved is the only thing that needs to be taken care of on your end. This is due to the need for increased revenue generation, which is made feasible by greater customer engagement.

What are the Features a Fintech App Must Have?

1. An easier-to-use interface

The world of finances has always been difficult to understand and navigate. As in the financial application development fields, you must concentrate on creating an application with a streamlined user interface that somehow makes managing funds easier.

Eliminate any complications that may arise during the procedure. You can provide users a smoother experience, from an intuitive user interface to educational content.

2. Cross-form capabilities

There should be a wide range of advantages to having the fintech program on the user’s smartphone. Their lives ought to become simpler as a result. In order to improve the efficiency of your application, you must now combine its features with those of third parties. This enables the smooth facilitation of payments and other activities. Your fintech application must accommodate every second payment or claim a user makes. Your user shouldn’t be able to consider using another program while using it.

3. Use of gaming

Today’s top financial app developers place a lot of emphasis on increasing user involvement in their applications. Thanks to the development of strategies like gaming, they are able to do so. Who doesn’t want benefits? Everyone loves cash bonuses and rewards in exchange. A cashback or scratch-off reward can pique a user’s interest in returning repeatedly in the hopes of winning cash. Therefore, each fintech application should have a gamifying interaction system in place.

4. Voice support

One of the tech features that is quickly evolving in your search for “how to create a fintech app“ is voice assistance. People who have a smart virtual system installed in their homes will find this to be of the utmost ease. Many people are also interacting directly with virtual aids because of the wonder and experience they provide. For speech-based functionalities like results retrieval and voice-based searches, among others, your app should support the voice system.

Other essential features for developing fintech applications include app tours, material geared toward millennials, data visualization, and biometric security. They continue to change because there is no one size fits all strategy for the ecosystem of technology and its goods. It always has something special to offer in every effort.

What are the Various Types of Fintech Apps?

There are currently numerous fintech businesses accessible, not just one. They are primarily grouped by the sector they work in. These fintech businesses consist of:

1. Lending: These programs have made it easier for individuals to obtain credit. Consumer loans are available through this type of loan lending mobile app development simply by heading to apply. They provide automated lending procedures, so approval occurs promptly as well.

2. International money transfers: Today’s fintech companies offer faster, less expensive, and more secure methods to conduct or execute international money transfers.

3. Equity financing: This part facilitates raising capital for businesses. Some of them link vetted companies and accredited investors. Others, however, use crowdfunding methods and let investors make investments.

4. Payments: The most common service provided by businesses in the fintech mobile app development and domains is payment solutions. Users can transfer money using these applications without going to a bank or physically going there. They can now make payments without having to leave their houses because they can do so from there.

5. Consumer banking: Fintech companies give consumers some better and more competitive banking choices, but they typically charge a higher fee for these services. Companies like Netspend are Fintech app examples for fintech consumer banking companies.

What are Some Innovative Trends for Fintech App Development?

More major advancements in the field of Fintech are expected to occur in 2023. Here are some noteworthy trends that are major forces behind innovation in the fintech sector:

1. Open banking: The introduction of open banking relates to data exchange between banks and financial services companies. Open banking is growing in Fintech for additional advantages and functionality, from fintech app security to usability.

2. Autonomous finance: It is one of the main trends for the future. Financial services provided by autonomous funds emerged as in-person transactions became impossible. In order to give customers the best possible experience on mobile portals, autonomous finance employs automation, AI, and machine learning.

The Financial Brand reported that artificial intelligence will reduce bank operational expenses by 22% by 2030. Up to $1 trillion in savings could be realized consequently.

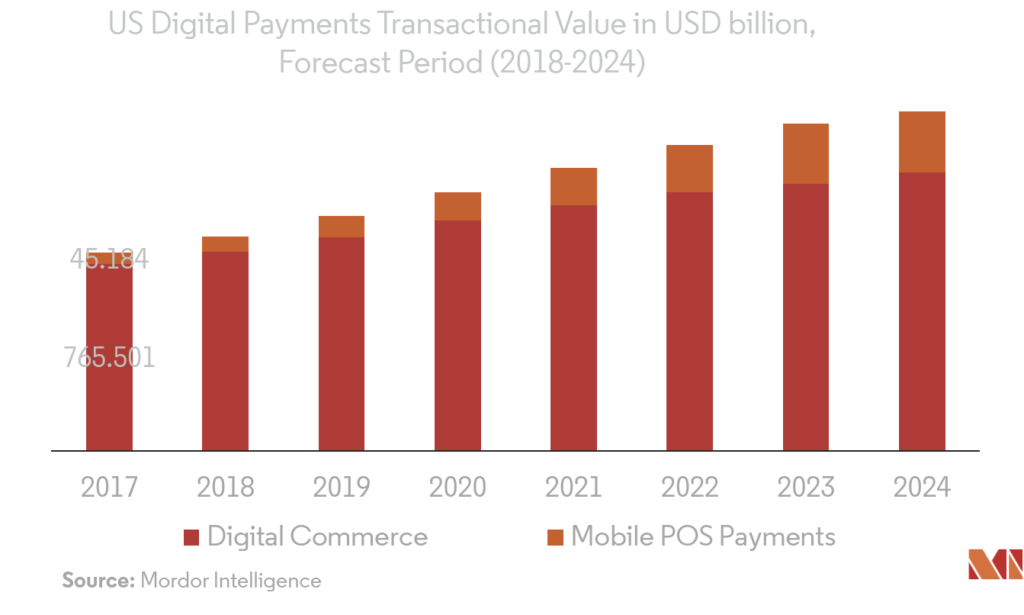

3. Cross-Border Payments and Contactless Transactions: The payments industry has advanced the most recent and is one of the most well-liked Fintech technology developments. It also has a strong presence in the Fintech sector. Some of the most recent Fintech developments in this creative sector include the growth of contactless transactions and cross-border payments. In 2023, they are predicted to remain a significant trend in the worldwide Fintech market.

What is the Technology Stack Used to Develop a Fintech App?

It is important to pay attention to what is actually accelerating or quickening the growth of fintech application development companies. There is no question or second chance that technology is what is causing this change in the digitization of the finance industry.

The main goal of fintech applications is to approach finances in a way that makes them simple to comprehend, run, and access. The array of technologies being used should be able to handle the complexity. Right from version controls to databases and programming languages, all of these are the tech stacks used in the development of fintech applications.

App Development for Fintech: How Much you Should Expect to Spend on Average

Every company has distinct requirements and preferred statistical operations. Finding out how much it costs to create a fintech app is not an exact science. The ultimate cost will depend on a variety of factors, including the interface, the project’s location and style, as well as its overall duration.

However, some cost estimations can provide a rough idea of how much, on average, the cost can increase in terms of affordability and moving forward with the concept of developing a fintech application. It is a short-term investment that will pay off more than normal and for a long time. Therefore, the average cost involved is what counts most.

The lowest cost to create a custom Fintech application that offers customers a secure and convenient online transaction method could be $40,000. It takes three to four months to mature.

On the other hand, you could spend anywhere between $30,000 and $50,000 on a banking program with a basic user interface and functionality. You could spend between $60,000 and $100,000 integrating modern technologies and better solutions into a Fintech app.

Create a Fintech app with enterprise-level Exato Software Business experts.

Now is the time to put some real effort into looking for and choosing a business that offers you a wealth of solutions. The best fintech app development companies outperform the competition in terms of features, security, reliability, and other factors. All you have to do is concentrate on choosing a top provider of financial software services, such as Exato, software your needs will be given top priority. Choose from the diverse portfolio to meet your range of requirements. Use the appropriate businesses to give your company the right boost.

How to Create a Fintech App?

1. Authenticating and managing users

Consider this to be the skeleton from which the muscles and organs of your software will hang. It is the preferred construction tool for creating apps. In addition, it offers administration, crash reporting, and secure user authentication. A variety of other Google services are integrated with Firebase to provide a comprehensive user experience.

2. Secure hosting

Go for a database hosting service in the cloud that is encrypted for app creation. It should be a Firebase product that works with every other Firebase product for a fluid user interface and development process. Automatic scaling, high performance, and ease of app creation are all features that should be there.

3. Payment processor

Select a worldwide payment provider. You no longer need to keep credit card information and can comply with PCI certification thanks to this solution that combines a number of payment service providers into one. It also combines with additional sources.

4. Making use of messaging

Your client support can be automated using Chatbot’s API and NLP, and machine learning. Using open-source libraries like Python you can create it to handle more difficult tasks like accessing tenant pre-approvals as this is driven via machine learning.

5. Including extra tools

The API has tools to show the financial health of a company if you want to add financial management to the landlord’s dashboard. D3 is the framework of data visualization that is a requirement for your program. D3.js is a JavaScript tool for data manipulation that produces HTML, SVG, and CSS visualizations. This API is required if you want to integrate corporate resource planning and budgeting or if you simply want to visualize financial data.

6. Requirements of the law

Keep in mind that we are discussing very confidential information. Hackers would adore gaining access to this information at your expense. So, here are some additional tasks you must complete:

- Know about various legal agreements related to using the APIs to get through users’ financial info.

- Make a strategy for management and data privacy.

- Obtain protection so that you stay safe even if there is any issue with the event.

- Devise a plan for company continuity and disaster recovery.

Your duties extend beyond merely rendering a service. Your customers are entrusting you with their entire life assets. These additional measures will greatly increase both their confidence in you and their perception of the dependability of your app.

Final Words

Disruptive fintech ideas can be transformed from concepts to working products, which then enables these products to be used by millions of users. Engage reputable companies to assist you.